In business, time is money and accurate information is power.

For small business owners, the difference between growth and struggle often comes down to how quickly you can see and respond to your numbers.

This is where real-time reporting changes the game.

Instead of waiting weeks for an accountant to “close the books,” real-time reporting gives you instant access to your financial data. You see what’s happening in your business as it happens allowing you to make smart, timely, and profitable decisions.

What is Real-Time Reporting?

Real-time reporting is the process of tracking, processing, and presenting your business data instantly without delays.

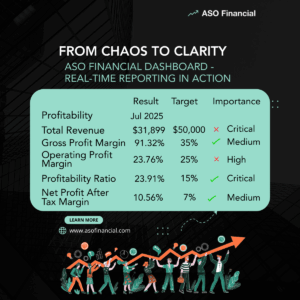

Think of it as a live dashboard for your business. You can see:

- Current sales and revenue

- Outstanding invoices

- Expenses and cash flow

- Profit margins

- Tax liabilities

No waiting for end-of-month summaries. No manual spreadsheet updates. Just clear, up-to-date numbers that empower you to act fast.

Why Real-Time Reporting is a Game-Changer for Small Businesses

Spot problem early

Without real-time data, financial problems can sneak up on you. Maybe a major client payment is overdue, or a new marketing campaign is costing more than expected. By the time you notice, the damage is done.

With real-time reporting, you see issues immediately giving you the chance to fix them before they snowball.

Make Confident Business Decisions

Should you hire a new employee? Increase your marketing budget? Open a new location?

Without accurate, up-to-the-minute numbers, these decisions are risky. Real-time reporting gives you the facts you need to back up your choices no more guessing or “gut feeling” management.

Improve Cash Flow Management

Cash flow is the lifeblood of any business. Real-time visibility lets you monitor how much money is coming in and going out every single day. This helps you avoid shortfalls, plan ahead for large expenses, and keep your operations running smoothly.

Stay Compliant and Avoid Penalties

Tax rules change. Compliance requirements shift. Real-time systems can flag missing data, unpaid obligations, or errors before they lead to fines or legal trouble.

Gain a Competitive Edge

In today’s market, speed wins. The faster you can respond to customer needs, market changes, or new opportunities, the better. Real-time reporting ensures you’re not operating with yesterday’s information.

From Chaos to Clarity: Why It Matters

Without real-time reporting, your finances can feel like a disorganized puzzle bits and pieces scattered across spreadsheets, invoices, and bank statements. This chaos leads to:

- Missed growth opportunities

- Unnecessary expenses

- Stress and burnout from constant “firefighting”

With real-time reporting, you gain clarity. You can see exactly where your business stands and where it’s headed. That clarity means confidence and confidence means growth.

How ASO Financial Helps Small Businesses Win with Real-Time Reporting

At ASO Financial, we specialize in helping small businesses transform how they see and use their financial data.

Here’s how we do it

- Custom Real-Time Dashboards

We set up reporting tools that are tailored to your business. You’ll have one simple dashboard that shows the numbers that matter most to you.

- Expert Analysis Not Just Data

Numbers mean nothing without context. We explain what your reports actually mean and what actions you should take next.

- Integration with Your Existing Systems

No need to start from scratch. We connect your real-time reporting to your current accounting, payroll, and sales tools.

- Continuous Support

We’re not just “setting you up and leaving.” We work with you regularly to update reports, track performance, and adjust strategies.

The CFO Advantage for Small Businesses

Large corporations have Chief Financial Officers (CFOs) to oversee financial strategy. Most small businesses can’t afford a full-time CFO but with ASO Financial, you don’t need to.

Our outsourced CFO services give you access to that same high-level expertise on a flexible basis. That means:

- Better financial forecasting

- Smarter budgeting

- Stronger profit strategies

- More investor and lender confidence

Real-Life Example

Imagine a small business owner named Lisa running a boutique in Houston. Before working with ASO Financial, Lisa only reviewed her financial reports once a quarter. By then, it was too late to adjust her marketing spend or fix cash flow problems.

After setting up real-time reporting with us, Lisa could:

- See her daily sales trends

- Spot slow-moving products before they ate up storage space

- Plan seasonal marketing campaigns using actual data

- Increase her profit margins by 15% in six months

Ready to Go from Guessing to Growing?

If you’re tired of making blind decisions, struggling with cash flow, or feeling like your business is running you, real-time reporting is the solution.

At ASO Financial, we make the process simple, affordable, and effective so you can focus on what matters most: growing your business.